How does a foreclosure affect your credit?

Foreclosure almost always has a lasting impact on your credit report. If you are in this situation then it is important to read and understand the entire scenario.

How long does foreclosure affect your credit?

Once the home is lost to a foreclosure action, the homeowner and any other co-signor will have a significant drop on their credit score. The Fair Isaac Corporation (FICO), one of the largest and best-known companies that provide calculation for a person’s credit score, has stated that a person with a good credit score will have a 100-point drop and a person with an excellent credit score will have a 160-point drop. Evidently, the higher your credit score the higher the impact.

When will a foreclosure start impacting your credit?

You mortgage lender reports payment that is late for 30 days or more to credit bureaus. This means that the negative impacts would start even before the foreclosure process even begins, and each missed payment would create a snowball effect. The foreclosure processed typically start after 90-120 days of failure to make payment. The process can take several months to be completed and thus creating around 6-24 months’ worth of missed payments

How is credit score calculated?

Credit scores are broken down based on payment history, amounts owed, length of credit history, types of accounts, new credit and types of credit used. Out of this, payment history (35%) and amount owed (30%) is given the most importance.

How soon can I buy a home after a foreclosure?

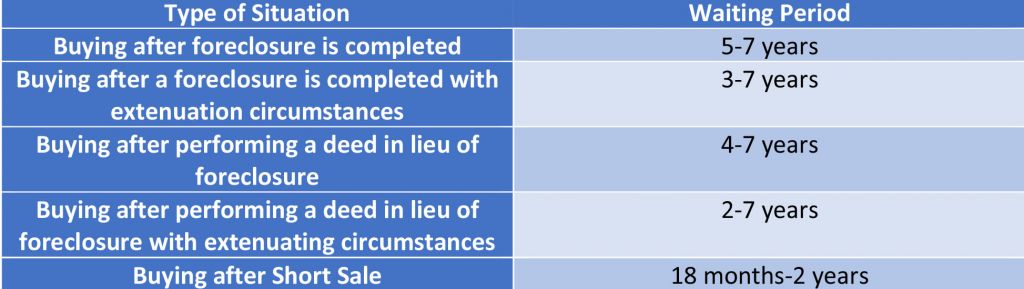

It is a normal scenario where the borrower would like to seek a future mortgage. While this effort may take some time, it is not impossible. To qualify for a future mortgage most lenders have a 620-minimum credit score requirement. Although this may be the case, there are some waiting periods involved.